In August 2025, Jakarta Academics hosted a special Enrichment Programme (EP) focused on a crucial real-world skill often overlooked in traditional education: financial literacy.

Contents

Why Financial Literacy Matters for Students

While school curricula cover academic subjects extensively, real-world financial skills are rarely addressed. This enrichment initiative was created to bridge that gap—empowering students with the tools and mindset to manage money wisely from a young age.

In today’s world, even high earners can find themselves struggling with debt, poor budgeting, and impulsive spending. This EP aimed to prevent those pitfalls by teaching students how to track income and expenses, save effectively, and make informed financial decisions early in life.

Key Activities During the Enrichment Programme

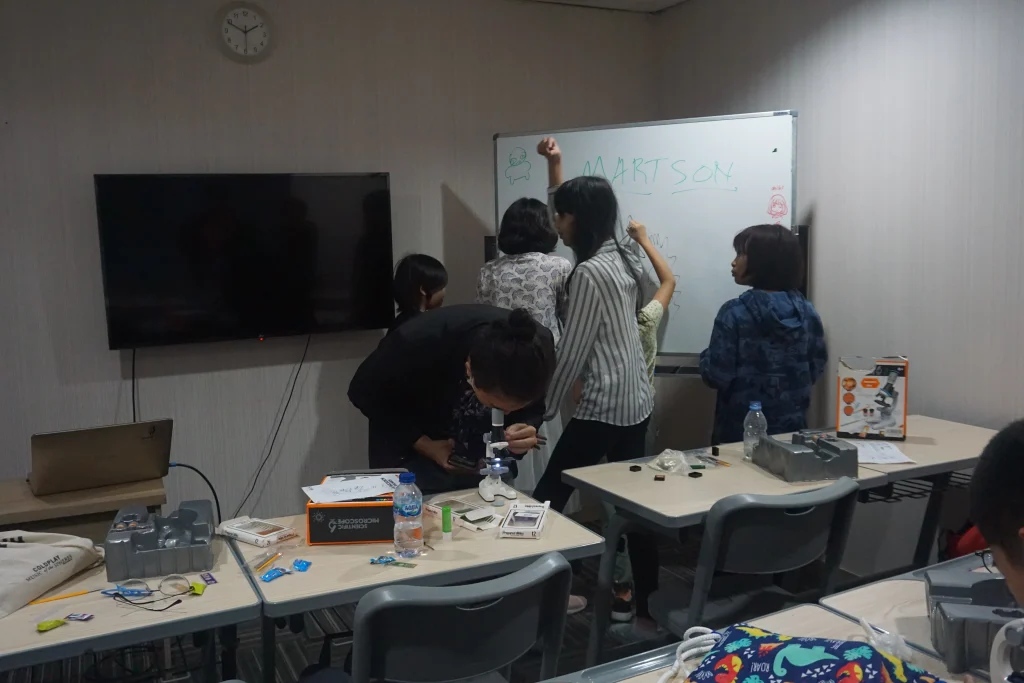

Led by Ms. Grace, a seasoned business teacher, the programme offered a combination of simulation, real-world tools, and reflective discussion. Here’s a breakdown of the engaging and educational sessions:

1. IEX Financial Simulation

Students participated in a hands-on simulation featuring:

- Flash cards and toy money

- ATM and credit card props

- Interactive roleplay

Roles included:

- One student as a BANK BCA officer

- One student as a Credit Card Officer

- One student as a Flash Card Moderator

- A teacher playing the Cashier

- Three groups of students acting as consumers

This immersive activity helped students grasp basic financial operations and understand the difference between spending with cash, debit, and credit.

2. Real-Life Money Hacks

To bring theory into practice, students were introduced to money tracking apps. These tools demonstrated how digital budgeting works and encouraged students to start tracking their own spending habits.

3. Myth-Busting Money Quiz

In a short quiz session, students were challenged with common financial myths:

- “Rich people don’t have money problems” – Most students answered “yes,” but discussions revealed that even the wealthy struggle with managing finances.

- “Money means more happiness” – Students learned that while money can increase comfort, true happiness is also tied to health, relationships, and purpose.

4. Student Reflections

At the end of the session, students reflected on their learning. They shared insights on how their views about money had changed and how they planned to apply their new knowledge in everyday life.

Teacher’s Message: Learning Beyond the Textbook

Ms. Grace emphasized that while textbooks offer important concepts, life itself is the ultimate classroom. She shared:

“With this EP on financial literacy, we hope students will learn to manage their income and expenses wisely. Real-world lessons are essential. Learning doesn’t stop at theory—it must be practiced.”

Conclusion: Building Financial Confidence for the Future

The August 2025 Enrichment Programme at Jakarta Academics was more than just an activity—it was a stepping stone towards financial empowerment. By making financial literacy fun, interactive, and relevant, the school aims to instill lifelong money habits in students, preparing them for the challenges of adulthood.